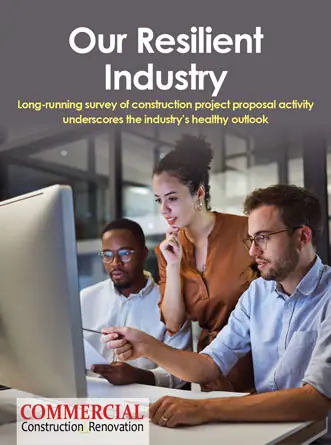

With the rise of technology and mobile banking, the relationship between customers and their bank tends to be transactional, at most. The truth is, given that banks likely hold power in most if not all your financial estate, your banking relationship should provide you with more value than a simple ‘transaction experience. About the author: Benjamin Frank Executive Vice President, Head of Commercial Lending Sunwest Bank.

When it’s all boiled down, banks offer comparable products and services across the board. What really differentiates institutions and allows them to stand out is the service they provide and the relationships they build. Oftentimes, smaller, community-focused banks have a more personal relationship and tailored approach with clients that goes beyond the standard.

When selecting a financial institution that values personal relationships, there are several important components to take into consideration:

Niche Experience – Any bank you chose should have knowledge and experience within your specific industry. For example, banks that understand the commercial construction industry, and the associated risks, are in a better position to offer good advice and the right kind of financing based on your needs both now and for the future.

A Personal Touch – Before you move forward with selecting a bank, it is important to ensure that you will have a consistent point-person and advocate for all interactions. Your banker will get to know your business inside and out and can offer sage advice as well as have full accountability for your account. Personal customer service isn’t found calling a bank’s toll-free number or sending an email, it’s created by building a strong, personal relationship. Not to mention, when assessing higher risk situations, personal bankers who go beyond the transaction can consider other factors, including an applicant’s character, established trust and credibility that have been built over the length of the relationship.

Financing Options – Financing is critical to anyone in the construction business. A bank should have a variety of customizable loan options and the ability to structure solutions that go outside the box, depending on the client’s specific needs.

Access to Leadership– While having a personal banker is imperative, it’s also important to have access to the bank’s leadership team. An open-door policy to executives ensures you have the ear of the ultimate decision-makers when seeking financing.

Playing Your Part

While there are undoubtedly things your bank should be doing for you, strong relationships need to be reciprocal. Business owners can help to build the relationship too by being proactive and transparent in communications with their banker. It’s always a good idea to share current company standing and any future plans, especially as it relates to cash flow. Your banker should know what’s in the pipeline so they can understand how your resources are being allocated as well as any potential risk factors and predict future needs so they can best consult and advise.

It’s also important to remember that bankers are humans too. Don’t be afraid to share personal information, as you see fit. At the end of the day, it only helps to further strengthen your relationship. Choosing a bank that values its relationships above all else means that a bank can offer personalized solutions.

The Takeaway

When there is a strong relationship between banker and lender, a banker can do so much more than lend money. When your banker understands your business, they can also help you make smarter financial decisions that align with long-term goals.

In the construction industry specifically, a project’s success can be completely contingent on getting a personalized loan tailored to the situation. By banking with a smaller entity that knows you personally and understands your specific business needs, you can create a relationship where out-of-the-box solutions are possible.

Benjamin Frank

Executive Vice President, Head of Commercial Lending Sunwest Bank

Benjamin Frank joined Sunwest Bank in 2006 and oversees the procurement and management of the bank’s commercial loan clients. With 15+ years of experience servicing a broad array of commercial businesses, Benjamin’s skills include mergers & acquisitions, structured finance, healthcare, commercial real estate, treasury management and financial due diligence.

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.