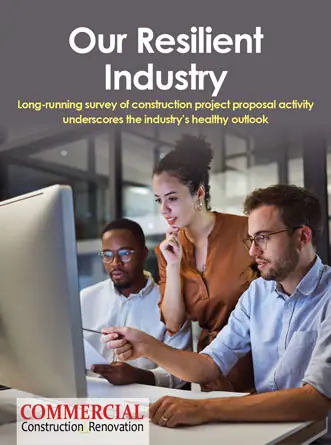

Commercial real estate can be a lucrative way to earn extra income. You could even turn this sort of venture into a full-scale business. Before you do either though, you may need to ask yourself a few questions to ensure you have what it takes to succeed. To help you out, here are a few of those questions for you, as well as some essential resources and links to help you answer them.

Do I need millions to invest in commercial real estate?

Absolutely not! While you can potentially make millions, you may not need that much upfront capital to get started. Here’s what you do need to play it smart.

- Pointers from seasoned investors, so you can come up with a business plan.

- Definitely a budget! You will need to be able to cover upfront and operating costs.

- A good credit score if you plan on using a loan to buy an investment property.

Is it smart to invest in real estate during a recession?

The answer to this one could be a “yes,” if you can comfortably afford to buy property right now. Whether or not you can score a good deal may depend on a few factors. Here’s more info:

- One perk of the pandemic and recession is that interest rates are insanely low.

- The only catch is that many areas may be seller’s markets, which drives up prices.

- Although with many businesses closing up shop, you may be able to score a deal.

Do I need to plan for a long-term real estate investment?

Maybe. Honestly, this depends on what type of investment you are interested in making because some yield immediate profits while others require more time. These tips will help:

- You can take online courses that will help you get started with flipping real estate.

- Securing financing can also be more challenging when you plan on fixing and flipping.

- Once you’ve built a successful commercial real estate business, you can always sell it.

What else should first-time real estate investors know?

We’ve covered the basics but there are a few additional tips and resources you may need to protect your ROI and finances. That includes the following:

- Before investing in real estate, assess your financial goals and current savings.

- You should also be aware of tax credits and rules that can save your business money.

- Stay on top of your obligations, like filing your annual report, to avoid costly fines down the line.

If you’re already a savvy business owner, investing in commercial real estate could be a phenomenal way to pad your portfolio. Just be sure to take stock of your current financial situation, think carefully about your goals, and know where to turn for tips and advice.

Photo Credit: Unsplash

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.