When it comes to life insurance, there are a lot of misconceptions out there. A lot of people think that life insurance is only necessary for older couples who have families and assets.

But this isn’t always the case. Younger Americans can benefit from life insurance coverage as well!

In this article, we will discuss the benefits of buying life insurance in your twenties.

How Does It Work?

To understand the benefits of life insurance, it’s important to first understand how it works. Life insurance is a contract between you and an insurance company.

You pay premiums (monthly or yearly payments) to the insurance company, and in exchange, they agree to pay a death benefit to your beneficiaries (the people you designate to receive the money from your policy) if you die while the policy is in effect.

In case of any emergency, you will not need to contact the paycheck advance app to receive the money, because the insurance will cover the expenses according to the conditions specified in the contract.

The death benefit can be used for anything your beneficiaries want – from covering funeral expenses and outstanding debts to providing financial security for their future.

There are two main types of life insurance: term life insurance and whole life insurance.

Term life insurance policies provide coverage for a set period (usually 10-30 years), and whole life insurance policies provide coverage for your entire life.

Life Insurance for Youth Americans

Lots of young people in the United States think about life insurance as an option for older people, but they should change their opinion.

It may feel too early to start thinking about life insurance when you graduated just a few years ago or have just begun your first job. Starting early could be beneficial in the long term.

It is always less costly for a younger person to purchase insurance than for an older person.

GOOD TO KNOW: The cost of your life insurance depends on your age and health.

You are a young and healthy human = you’ll likely pay much less.

In this way, life insurance for a 21-year-old American is a better deal than life insurance for a 46-year-old, without any doubt.

Have never wondered about life insurance? Perhaps, now is a good time to consider it!

Federal Employees’ Group Life Insurance (FEGLI) is considered the most popular and biggest insurance program all over the world.

Over four million persons are covered by it. Among its customers are federal employees, retirees, and their relatives. According to this program, the government will cover one-third of the price and you should pay the rest.

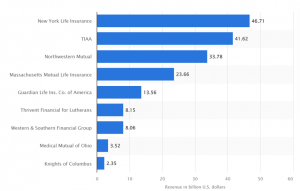

Top U.S. Mutual Life & Health Insurance Companies in 2020, by revenue

Types of Life Insurance

There are 2 types: term and permanent life insurance.

Term Life Insurance

Term life insurance, also called pure life insurance, is a type of death benefit that pays the policyholder’s heirs for a set period.

As an example, a term life insurance policy can offer $150,000 worth of coverage over 15 years and cost $15 monthly until the end of the term.

A beneficiary, who is named on the policy, receives the $150,000 if the insured passes away or is seriously injured.

GOOD TO KNOW: This type of term life insurance is often pointless if you are a 20 years old American, which has few debts and no family to support.

Permanent Life Insurance

Permanent life insurance is a general term for life insurance policies that do not reach maturity.

In contrast to term insurance, permanent life insurance offers more than just a death benefit.

One more benefit for young people is accumulated cash value. If you use life insurance policies constantly, you have a great ability to accumulate cash value, and the younger you are, the better it works.

There are various types of permanent life insurance:

- whole life is the safest

- a universal life (UL),

- variable life is the riskiest

- an indexed universal life (IUL).

Term Life Insurance or Whole-Life Insurance?

Consider whole life insurance.

Structured whole-life payment schemes: 10-pay or 20-pay policies that become fully funded after only 10 or 20 years, and then you’re covered forever.

Whole-life policies will begin to accrue a cash value that increases over time as dividends are credited.

What is Term Insurance? It can end while you still need coverage if you buy it young, forcing you to purchase a term policy again, more expensive later as you are older.

Benefits and Drawbacks of Buying Permanent Life Insurance in Your 20s

Benefits:

- Cheaper premiums than if you have insurance when you’re older.

- Long-term death benefit coverage.

- The accumulated cash value is available for use during your lifetime.

- Possibility of increasing coverage at a later date without re-examination.

Drawbacks:

- May be required to pay premiums for a longer duration.

- Can`t require insurance coverage.

Reasons to Buy Life Insurance Young

1. Protection Against a Catastrophic Accident

For instance, if you have a debt that was consigned by another person, of course, you don’t wish for unforeseen expenses as a result of your passing.

As an advantage, they could receive a tax-free lump sum of money in the event you pass away and use that benefit to pay off the loan.

2. To Avoid Putting Your Closest in a Terrible Situation

You have to understand that, in most cases, the family relies on your income. If something bad happens to you, you may survive thanks to life insurance.

Let’s picture a simple life situation: you decided to have children with your partner, surely, you want to help protect their future financial security if you pass away someday because they won’t be able to live on your money anymore.

The best way to give them a hand or help in the future is to sign up for life insurance when you’re younger.

1. Medicine

Nowadays, health problems are expensive things. By postponing life insurance, you may end up paying a higher price. An assessment of the medical condition is conducted as part of the life insurance application approval process.

GOOD TO KNOW: As you age, you are more likely to develop health problems that may require you to pay higher premiums or not be eligible for insurance.

Summing Up

Everybody knows that medical insurance is not the priority for young people, but considering all the information we have written before, every person should think carefully about it.