Stabilization was the main direction within the industrial real estate market in 2024. Upon a closer look, manufacturing is experiencing a development surge, while vacancy rates are on the uptrend even as some markets post double-digit yearly rent growth.

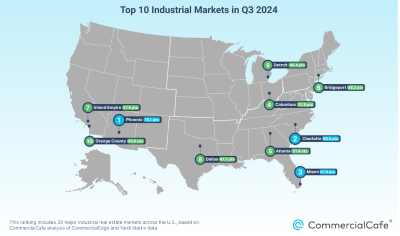

To best capture the state and direction of the industrial real estate market, we looked at key performance indicators across 30 major industrial markets in the U.S. and ranked them based on several metric categories: vacancy, pipeline, average rent, upcoming loan maturities, and quarterly shifts in online searches for industrial space.

The Atlanta real estate market made the list at #5, scoring well across the following metrics:

- The Atlanta market marked the 10th-largest expansion in Q3 2024, adding 2.8 million square feet for a 0.5% inventory increase.

- The metro recorded the 5th-lowest percentage of industrial loans maturing in 2024, with 2.8% of its $12 billion in industrial loans reaching maturity this year.

- At the close of Q3, Atlanta recorded a vacancy rate of 6.1%, trending up after a 0.4% quarter-over-quarter increase.

- Looking at the pipeline, the market has now 8.7 million square feet of industrial space under construction – translating to 1.5% of its current inventory.

General Key Highlights:

- Overall, Phoenix claimed the top spot in our ranking report for industrial real estate followed by Charlotte and Miami in second and third place.

- With construction slowing down across the board, the pipeline for the 30 major markets in the study totals 200 million square feet. Phoenix leads the way with the largest upcoming inventory at 32.6 million square feet.

- Notably, 29 out the 30 markets in our study experienced rent increase in the last year, with Orange County boasting the highest rent ($15.7) per square foot.

- Bridgeport had the lowest vacancy rate in the country at 3.8%. Also, 28 out of 30 markets saw rising vacancies year-over-year.

Read the full article and see how the other cities fare here → https://www.commercialcafe.com/blog/national-industrial-report/#1726056732815-929a6faa-80a5

Feature Image Courtesy of: Commercial Cafe