Following the rapid expansion seen in the first quarter of 2025, the U.S. flexible workspace market in Q2 reveals a sector in strategic transition, moving away from the growth phases that characterized much of the last two years and toward a more measured and optimized footprint. After a robust 3% square footage increase in Q1 — adding nearly 4 million square feet of flexible workspace nationally — Q2 expansion slowed dramatically to just 0.3%. This sharp deceleration signals that operators are shifting focus from expansion to portfolio rationalization amid evolving hybrid work demands and economic pressures.

Geographically, the data paints a nuanced picture of growth and contraction. For example, Manhattan, N.Y. – the nation’s largest coworking market by space allocation – saw its total footprint shrink by 4% alongside a 5% drop in location count. However, the average size of its remaining spaces increased modestly, signaling a strategic pivot toward fewer, but larger, high-end venues. In contrast, emerging markets – like Long Island, N.Y.; Birmingham, Ala.; and West Palm Beach-Boca Raton, Fla. – recorded substantial footprint gains, demonstrating operators’ increasing appetite for less-saturated, secondary markets.

Key takeaways:

- Rationalization after years of expansion: U.S. coworking location count dips for the first time in the post-COVID era, signaling a cooling national footprint and a more measured approach to growth.

- Shift toward larger, more efficient spaces: Operators are prioritizing amenity-rich hubs as average coworking location sizes increase.

- Secondary markets gain momentum: Areas like Birmingham, Long Island, and West Palm Beach fuel growth, while major hubs such as Manhattan continue to face headwinds.

- Regus and HQ solidify their lead: The industry’s biggest players drive expansion through strategic portfolio management and continued dominance.

The National Coworking Footprint: Slow Growth Hides a Market Split

The national flex office presence in the U.S. recorded just a marginal rise in Q2 2025 as the total flexible workspace inventory edged up by just 0.3% to reaching approximately 141.25 million square feet compared to 140.76 million in Q1. This slight increase marks a sharp contrast to the 3% surge seen earlier in the year, when nearly 4 million square feet was added across the country.

Beneath this headline of nationwide stability lies a much more dynamic and uneven story at the market level. On one hand, Manhattan, N.Y. – once the symbol of high-powered flexible workspace demand – experienced its first quarter of contraction with the total footprint shrinking by 4% to 10.91 million square feet. The slowdown reflects the city’s oversaturation and high operating costs, prompting major players to reassess their space allocations and exit non-essential leases.

But, just across the East River, Brooklyn, N.Y., tells a different story: The borough posted a healthy 5% increase in flexible offices, illustrating a growing appetite for flexible work environments in less traditional neighborhoods. Here, coworking is being redefined by fewer high-rises and more adaptive spaces that blend into residential surroundings. This micro-shift within New York City captures a broader trend of demand flowing toward areas that balance urban energy with neighborhood-level accessibility.

Elsewhere, shared office space performance across major cities was steady, but regionally nuanced. In the Midwest, Chicago extended its strong momentum with a 2% increase to reach 8.2 million square feet. This followed a standout Q1 in which the city added 16 new coworking locations and grew its total footprint by 16%, fueled by tech and professional services firms seeking centrally located, scalable space.

Washington, D.C. posted a 1% increase, buoyed by the legal sector demand, which continues to anchor the region’s coworking appeal. Los Angeles added 1% as well, Dallas-Fort Worth went down by 2% and Miami recorded a 2% growth in square footage. Notably, these cities represent mature markets, where operators appear to be pausing expansion in favor of fine-tuning service offerings and maximizing occupancy rates.

Emerging & Secondary Markets: The Engine of Coworking Growth in Q2

As giants like Manhattan and LA slowed or slipped in Q2 2025, emerging markets stole the show. In fact, secondary cities have driven the real coworking surge by posting strong gains and redefining momentum. In a post-hybrid era shaped by commute fatigue and soaring costs, these leaner, high-potential hubs are fast becoming the smart play — for operators and occupiers alike.

Rather than continuing to chase an aggressive surge, operators appear to be shifting toward portfolio optimization by focusing on long-term sustainability, as opposed to short-term expansion. And, the boom is no longer limited to coastal powerhouses. Instead, it’s increasingly anchored in cities that promise not just growth, but balance between cost and community; convenience and creativity; and access and ambition.

Long Island, N.Y., led the charge with a striking 11% increase in flexible office space – a clear indicator that suburban demand around the New York metro area is accelerating. Clearly, professionals and companies alike are showing increased preference for flexible office options closer to home, particularly in locations that offer commuter convenience without the overhead of Manhattan rents.

Not far behind, Birmingham, Ala., posted a 10% gain to further establish itself as a rising star in the flexible workspace sector. With a growing tech ecosystem, affordable living, and strong university ties, Birmingham is quickly shedding its secondary status and becoming a viable destination for entrepreneurs and remote workers alike. Additional strong performances came from Florida’s West Palm Beach–Boca Raton area with a 9% boost; California’s Central Valley with 8%; and both San Diego and Detroit growing by 6%. In each of these markets, operators are capturing momentum driven by regional talent pools, migration trends and lower operating costs.

At the same time, some of the hottest markets from Q1 lost steam in Q2, pointing to a maturing mindset among coworking providers. Namely, Southwest Florida (which posted an 8% jump earlier this year) saw its momentum cool, while San Antonio – a standout performer in Q1 with an 18% increase – contracted by 5% in Q2. Phoenix and Bridgeport-New Haven, Conn., each recorded 3% declines.

Shifting Footprints: U.S. Coworking Location Count Contracts for 1st Time in the Post-COVID Era

The total number of coworking locations across the United States declined by 1% in Q2, falling to 7,742 from 7,840 in the previous quarter. This marks the first location count contraction after several quarters of steady expansion and signals a broader shift among operators.

Now, rather than pursuing new openings, providers are streamlining their portfolios with profitability and efficiency in mind. This pullback aligns with the industry’s evolving maturity, in which metrics like occupancy rates and average location size are taking precedence over raw expansion.

Manhattan, N.Y., led this wave of consolidation after reducing its location count by 5% to 267 sites. While this may suggest a softening market, it’s paired with a 1% increase in average location size, indicating a move toward fewer, but more competitive, amenity-rich hubs. Other major metros also scaled back, including Atlanta, which saw a 6% decline, as well as Dallas-Fort Worth and Denver, both down by 3%. Similarly, markets like Houston, Phoenix, and California’s Orange County posted more modest contractions between 2% and 4%, showing a consistent trend across several high-density regions.

Despite the overall decline, several markets defied the contraction narrative by adding new locations and demonstrating continued momentum. For instance, San Francisco, which saw a reduction in footprint in Q1, rebounded strongly in Q2 with the addition of eight new coworking spaces, a 6% increase that reflects renewed operator optimism. Likewise, Birmingham, Ala., maintained its rise as one of the most dynamic secondary markets in the country after expanding its location count by 10% and solidifying its status as a flexible office hotspot.

Other markets showing healthy growth included California’s Central Valley; St. Louis; Pittsburgh, Pa.; Charlotte, N.C.; San Diego; and Chicago, each recording increases of 3% to 5%. These gains highlight a targeted strategy among operators who are leaning into diversified, rise-friendly markets with favorable economic conditions, regional migration, and scalable demand. The mixed picture points to an industry that’s increasingly defined by surgical decision-making — cutting where needed and investing where it counts.

Bigger & Better: The Rise of Larger Coworking Spaces in a Mature Market

Nationally, the average size of coworking locations continued to go up in Q2 2025, increasing by 2% to reach 18,245 square feet. This steady rise reflects a clear change of direction among operators toward fewer but larger spaces that offer enhanced amenities designed to meet the evolving needs of hybrid workers and enterprise clients.

By focusing on scale, providers are seeking to optimize operational efficiency while delivering more value through well-appointed environments, collaborative zones and flexible layouts. The trend toward bigger, amenity-rich hubs builds on momentum from Q1 and signals a market that favors quality and experience over simply increasing location counts.

And, our analysis on specific markets reveals where this strategy is most pronounced:

As you might expect, Manhattan, N.Y., remains at the forefront with the largest average coworking location size at 40,859 square feet (up 1%), reinforcing its status as a premium, high-end market despite its overall footprint contraction.

Chicago and Brooklyn, N.Y., also show strong average sizes, standing at 28,671 and 22,430 square feet, respectively, with Brooklyn seeing a notable 6% increase that underscores growing confidence in these concentrated growth areas.

Meanwhile, emerging markets – such as Long Island, N.Y. (+11%); West Palm Beach-Boca Raton, Fla. (+9%); Kansas City, Mo., and Detroit (both +8%); and Cincinnati (+5%) – have experienced significant growth in average location size, thereby illustrating operators’ focus on expanding scale where demand is rising.

On the flip side, some metros have seen declines in average size. Namely, Pittsburgh, Pa. (-8%); Bridgeport-New Haven, Conn. (-4.8%); Salt Lake City (-4%); and San Francisco (-2%) — likely reflect the closure of larger legacy spaces or strategic downsizing as part of broader portfolio optimization efforts.

Flex Space, Full Price: Manhattan Leads, Suburbs Catch Up

The priciest coworking markets held their ground in Q2 2025, led by Manhattan, N.Y., where the current average price for a monthly membership stands at $339 — still the gold standard for premium workspace. Nearby, Brooklyn, N.Y., followed closely at $330, reinforcing New York City’s dominance in high-value coworking. Other urban powerhouses – like Boston, San Francisco, Seattle and Los Angeles – remained steady at $235 per month, underscoring stable demand in established, high-density metros where flexibility meets prestige.

Virtual office pricing also saw significant highs outside of downtown cores with New Jersey ($215) and California’s Central Valley ($204) commanding top rates and signaling rising demand for remote-first business setups in cost-conscious, commuter-friendly zones. Otherwise, day pass rates peaked in Fort Lauderdale, Fla. ($47); Boston ($45); and Phoenix ($42), revealing selective markets where short-term access still carries a premium. Across these segments, price leaders reflect the ongoing value placed on strategic location, convenience, and professional cachet.

Leading Operators: Expansion Amid Portfolio Refinement

The top five U.S. coworking operators — Regus, HQ, Industrious, Spaces and WeWork — continued to grow in Q2, increasing their national footprint by 6% to 1,938 locations, up from 1,822 in Q1.

Regus leads this growth with 68 new locations – a 6% increase that pushed its total to 1,141 nationwide and 920 within the top 50 metropolitan markets. This demonstrates Regus’s unmatched scale and ongoing aggressive growth strategy that’s particularly focused on consolidating leadership in major urban centers while simultaneously penetrating high-potential secondary markets. Not to be outdone, HQ distinguished itself with an impressive 14% nationwide increase to a total of 319 locations and a 10% growth rate in key metros. The latter is expanding its reach primarily through targeted moves into mid-sized cities and suburban areas, where demand for flexible office solutions is accelerating.

Meanwhile, Industrious and Spaces posted steady, but more moderate gains to maintain their positions within the competitive landscape, while WeWork’s footprint stabilized with a slight 1% increase that’s consistent with its ongoing restructuring efforts. This blend of rapid growth by some operators, alongside measured consolidation by others, reflects a maturing market where strategic portfolio refinement is as critical as expansion.

Q2 2025: Turning Point Toward Smarter Coworking Portfolios

The Q2 2025 coworking landscape clearly marks a strategic inflection point. Following the aggressive expansion of recent years, operators have begun to streamline their portfolios by consolidating locations, reducing presence in saturated urban centers and doubling down on growth markets outside traditional cores.

Methodology

- To compile this report, we used proprietary data from CoworkingCafe to determine the number of coworking spaces per market, as well as the total square footage and leading operators.

- The study relied solely on the listing data available on CoworkingCafe as of July 2025.

- The top 50 markets analyzed were established by our sister company Yardi Matrix and were ranked based on allocated square footage.

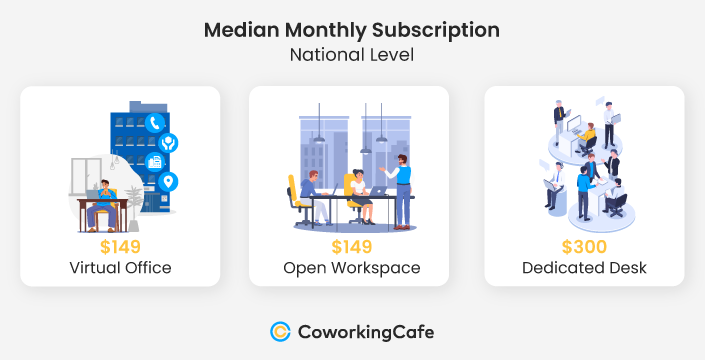

- In terms of pricing, we looked at the national median starting prices per person per month for virtual office, monthly memberships (open workspace + dedicated desk), day passes (daily open desk coworking) and meeting rooms (hourly booking).

- As the coworking market continues to mature, we’ve refined our categorization of workspace types to better reflect current offerings. Due to this methodology update, pricing data is not directly comparable with previous editions.

Here are more details on how the coworking market performed in Q2 2025:

- Less Inventory: The Atlanta market had 14 less coworking spaces by the end of Q2 2025 — reaching 233 — representing a 6% decrease Q-o-Q.

- Square Footage Decrease: Atlanta stood at precisely 4.73M sq. ft. at the end of Q2, a 2% decrease Q-o-Q.

- More Average Square Footage: the average square footage increased by 4% Q-o-Q, from 19,534 sq. ft. in Q1 to 20,299 sq. ft. in Q2.

- Pricing*: Virtual offices were $150/month at the end of Q2, slightly below the national level sitting at $159. Meeting rooms sat at $50/hour, above the national level of $45, while a day pass had a median cost of $40, above the national median rate at $30. Memberships were $197/month, below the national median at $225.