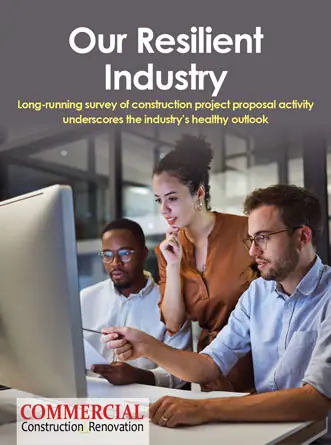

Most contractors expect demand for many types of construction to shrink in 2021 even as the pandemic is prompting many owners to delay or cancel already-planned projects, meaning few firms will hire new workers, according to survey results released today by the Associated General Contractors of America and Sage Construction and Real Estate. The findings are detailed in The Pandemic’s Growing Impacts on the Construction Industry: The 2021 Construction Hiring and Business Outlook Report.

The percentage of respondents who expect a market segment to contract exceeds the percentage who expect it to expand – known as the net reading – in 13 of the 16 categories of projects included in the survey. Contractors are most pessimistic about the market for retail construction, which has a net reading of negative 64 percent. They are similarly concerned about the markets for lodging and private office construction, which both have a net reading of negative 58 percent.

Other construction categories with a high negative net reading include higher education construction, which has a net reading of negative 40 percent; public buildings, with a net negative of 38 percent, and K-12 school construction which has a net reading of negative 27 percent. Among the three market segments with a positive net reading, two – warehouse construction (+4 percent) and the construction of clinics, testing facilities and medical labs (+11 percent) – track closely with the few segments of the economy to benefit from the impacts of the coronavirus.

Firms report that many of their already-scheduled projects have either been delayed or canceled. Fifty-nine percent of firms report they had projects scheduled to start in 2020 that have been postponed until 2021. Forty-four percent report they had projects canceled in 2020 that have not been rescheduled. Eighteen percent of firms report that projects scheduled to start between January and June 2021 have been delayed. And 8 percent report projects scheduled to start in that time frame have been canceled.

Few firms expect the industry will recover to pre-pandemic levels soon. Only one-third of firms report business has already matched or exceeded year-ago levels, while 12 percent of firms expect demand to return to pre-pandemic levels within the next six months. Fifty-five percent report they either do not expect their firms’ volume of business to return to pre-pandemic levels for more than six months or they are unsure when their businesses will recover.

Only 35 percent of firms report they plan to add staff this year. Meanwhile, 24 percent plan to decrease their headcount in 2021 and 41 percent expect to make no changes in staff size. Firms do vary by region in their hiring outlook. In the South, the percentage of firms that expect to add employees – 39 percent – is more than double the percentage that expect to reduce headcount – 17 percent. The outlook among firms in the Northeast is nearly opposite: fewer than one-quarter of respondents expect to increase their headcount in 2021 while 41 percent foresee a reduction.

Despite the low hiring expectations, most contractors report it remains difficult to fill some or all open positions. Fifty-four percent of firms report difficulty finding qualified workers to hire, either to expand headcount or replace departing staff. And 49 percent expect it will either get harder, or remain as hard, to find qualified workers in 2021.

AGC noted that 64 percent of contractors report their new coronavirus procedures mean projects are taking longer to complete than originally anticipated. And 54 percent of firms report that the cost of completing projects has been higher than expected.

Officials noted that firms are being more strategic about information technology as they try to remain competitive in the current environment. Sixty-two percent of contractors indicate they currently have a formal IT plan that supports business objectives, up from 48 percent last year. An additional 7 percent plan to create a formal plan in 2021.

Most firms plan to keep their technology investment about the same as last year. When asked whether they planned to increase or decrease investment or stay the same in 15 different types of technologies, the majority of respondents – ranging between 71 and 89 percent – said their investments would remain the same as last year.

Association officials noted with traffic still below pre-pandemic levels and a large pool of workers available, now is an ideal time to improve highways, repair transit systems, upgrade airports, modernize waterways and otherwise improve other types of public works. They added that one of the lessons from the late 2000s is that boosting federal infrastructure investments without backfilling state and local construction budgets is counterproductive. And that Congress and the incoming administration need to appreciate the risks of imposing burdensome new regulatory measures on an already-crippled economy.

The Outlook was based on survey results from more than 1,300 firms from all 50 states and the District of Columbia. Varying numbers responded to each question. Contractors of every size answered over 20 questions about their hiring, workforce, business and information technology plans. Click here for The Pandemic’s Growing Impacts on the Construction Industry: The 2021 Construction Hiring and Business Outlook Report. Click here for the survey results. Click here for a brief video summarizing the findings.

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.