New research by Interact Analysis shows that the hydrogen transportation market is still very much in its infancy. The new report covers all transportation ranging from passenger cars, trucks, trains and forklifts to the very largest off-highway machinery. Overall, fuel cells are the most mature powertrain technology for hydrogen transportation, with most of the development currently made in the on road and forklift segments. Development for larger machinery in the off-road sector is mainly in the research and development phase as companies begin to explore the benefits of hydrogen technology.

Passenger cars, by far, make up the greatest share of the hydrogen vehicle market. In 2021, almost 18,000 H2 units were sold, of which passenger cars accounted for nearly 90%. Due to the lack of government incentives, as well as the shortage of refueling infrastructure and high price of hydrogen, the hydrogen vehicle market is in its infancy. South Korea leads the way for the hydrogen passenger car market, with America and Japan following behind. Up to 2025, the market looks set to be dominated by passenger car sales, but from 2028 the hydrogen commercial vehicle market, in particular hydrogen trucks, is expected to outstrip the passenger car market.

China dominates the hydrogen commercial vehicle market, delivering over 2,000 units in 2021. This is due to strong government support for hydrogen initiatives, with much of the emphasis on city buses and trucks. Europe is the second largest market, with Germany dominating the majority of the European market, followed by the US, which deployed over 60 fuel cell buses by the end of 2021. Japan and South Korea first emerged in the hydrogen commercial vehicle market in 2017 and by 2021 both regions had delivered over 100 hydrogen commercial vehicles, respectively.

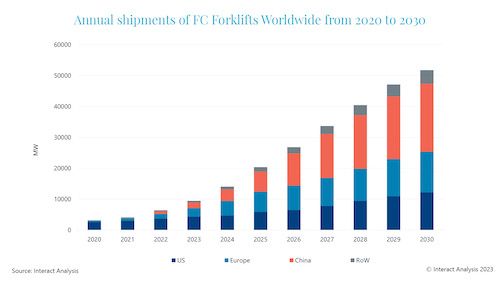

The hydrogen off-highway market is currently led by forklifts, but we are beginning to see some traction from larger vehicles, including haul and dump trucks, and excavators. North America is the largest market for hydrogen forklifts, with retail companies such as Walmart and Amazon the main customers. Europe, Japan and China are also developing demonstration projects for hydrogen forklifts but on a much smaller scale compared with North America. Government policies in China will increase China’s share in this market over the coming years. By 2030, over 20,000 hydrogen forklifts are forecast to be shipped in China, double the figure for the US. Early developments are also being made in the hydrogen rail, maritime and aerospace markets but developments will be limited this side of 2030.

Marco Wang, Research Analyst at Interact Analysis says, “Although the hydrogen vehicle market is very much in its infancy some significant developments are being made. By 2030 the global market will look very different and much more consolidated.

The TCO of hydrogen vehicles currently makes them unfavorable compared with traditional diesel alternatives. But the cost competitiveness of fuel cell powertrains will improve substantially when the demand scales up. Hydrogen availability is also an issue. But the commitment and ongoing actions of government authorities dedicated to hydrogen infrastructure provides a positive look on the future. More importantly, we really need to decarbonize vehicles where a full battery has proven unfeasible and fuel cell technology is the exclusive zero emission solution for them”.

About the Report:

This new research focuses on hydrogen fuel cell vehicles and the opportunities for OEMs and system suppliers. The research consists of two Interact Analysis reports each providing insight, analysis, data and forecasts, the Hydrogen in Transport Applications and the Hydrogen Vehicle and Component Market reports. The vehicle report is available as an independent report, while the component report is only available for those who purchase both reports.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com

*Featured Image Courtesy: Interact Analysis

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.

The 2024 virtual Men’s Round Table will be held Q4, 2024, date TBD.